/http%3A%2F%2Fprod.static9.net.au%2Ffs%2Fd14b3f34-3279-45dd-8bd3-c46cade7ced6)

Analysis shows areas in the northern beaches, inner west and eastern suburbs make good buys for investors looking to take advantage of the looming rental surge.

With international borders finally reopen as of today, February 21 and New South Wales welcoming the first flights carrying international tourists, the real estate industry braces for a surge in rental demand.

Keen buyers after long-term growth and strengthening rental returns can take this opportunity to invest at a time when rents are set to rise due to lack of supply, creating record-low vacancy rates across the nation.

“We are in a very unusual situation, with a backlog of arrivals waiting to enter Australia after two years of border closures, and in turn there is an opportunity for investors seeking both capital growth and rental returns, leading to strong total returns for landlords,” explains Pete Wargent, co-founder of Australia’s first national network for buyer’s agents, BuyersBuyers.

Wargent says the looming rental shortage is multifactorial, including a shift in household formation and lack of international investors driving new builds.

“We no longer have high volumes of investors from mainland China to drive the construction of new high-rise units, which has dampened the supply of new apartments,” says Wargent.

“A substantial number of young renters have also entered the rental market, as the lockdowns encouraged more renters to find their own space at the earliest available opportunity”.

Doron Peleg, CEO of BuyersBuyers adds that increased demand for additional space has been the other factor in the tightening rental markets.

“Many households have required office space to work from home, while wealthier households have taken the opportunity to buy second homes, which has depleted the available rental stock,” he says.

With a two-year backlog of arrivals waiting to re-enter Australia, rental demand is expected to jump in capital cities Sydney and Melbourne.

“We can expect to see national rental price growth rising into the 10 to 20 percent range forthwith, with most rental markets around the country already experiencing tight conditions,” Wargent explains.

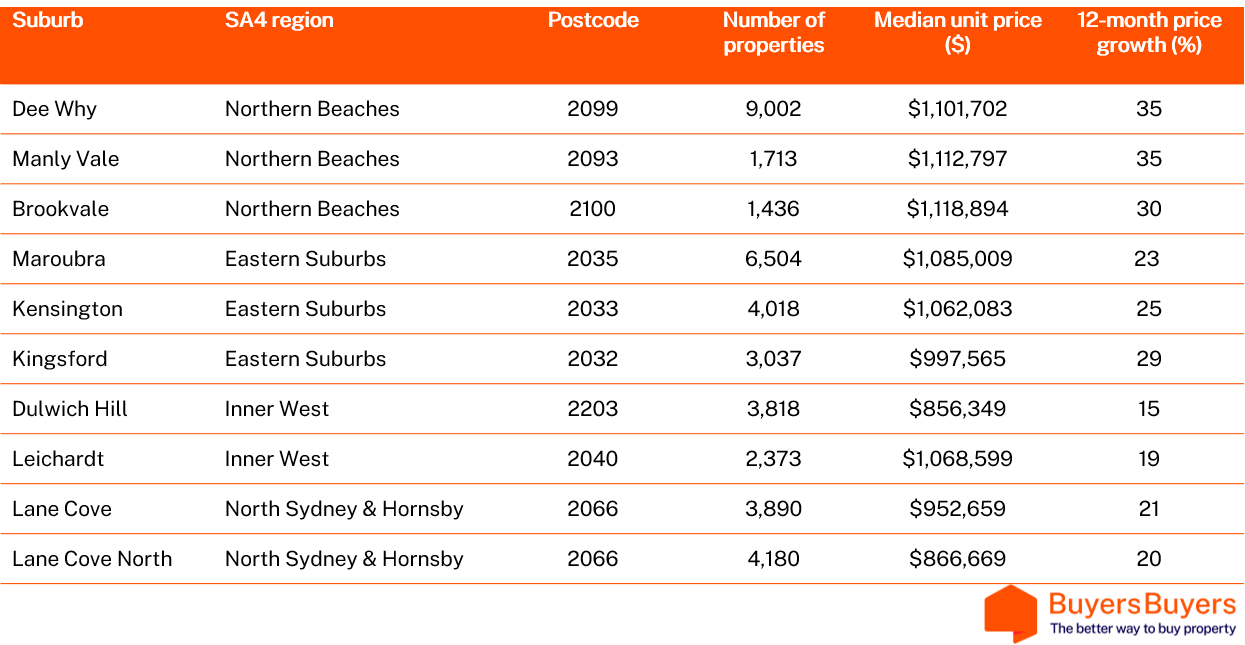

The Top 10 NSW suburbs for apartment investors

“The unit to house price ratio is at record lows, reflecting that affordability for houses is becoming a challenge for many investors,” Peleg says.

Instead, BuyersBuyers analysis shows opportunities for investors looking at apartments with a budget ranging from $800,000 up to $1.2 million, and requiring a rental yield of at least 3 percent. Capital growth plus the increase in rents should deliver strong returns.

“In the unit market, there are solid opportunities in many of the coastal markets on the eastern seaboard, as well as in Sydney’s northern beaches and eastern suburbs,” says Wargent.

They advise to look for boutique unit developments with reasonable strata levies, and if the budget permits, family-friendly units with owner-occupier appeal in popular suburbs where the supply is somewhat capped.

article by domain.com.au